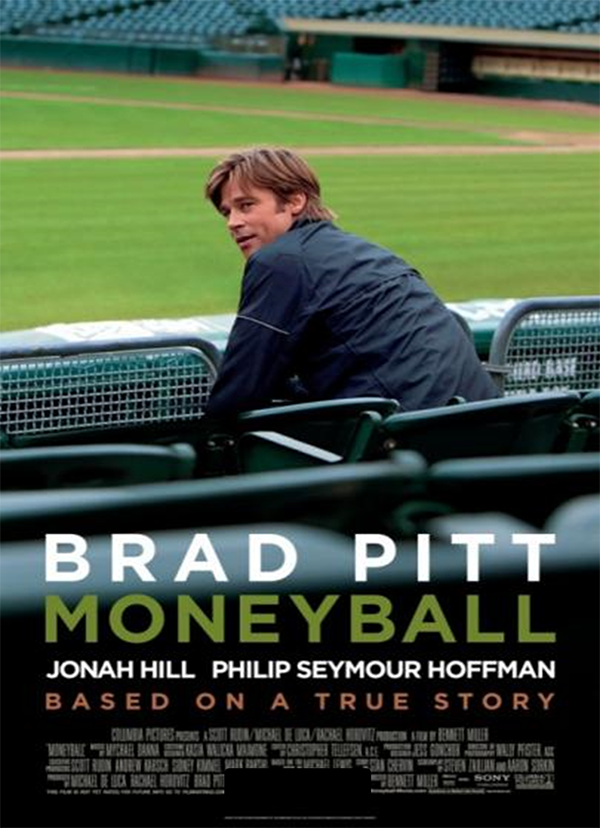

Let the ProRRT℠ help improve your investment selection the way “MONEYBALL” forever changed baseball player selection.

What’s “MONEYBALL”?

It’s not just the name of a very popular movie which, if you haven’t yet seen, you should. It’s the name given to a whole new way of comparatively evaluating baseball players – using performance metrics rather than the subjective opinions of baseball “scouts.”

The movie tells the story of how this occurred, and the struggles involved in changing the traditional system of baseball player evaluation and selection. It’s definitely worth watching.

What’s the connection with DTC’s Professional RapidReview Tool℠ (the ProRRT℠”)? In an almost identical way, we’re improving the way mutual funds are evaluated and selected.

The time-consuming, initial screening process for picking funds for further, qualitative due diligence, is no longer about the size and reputation of the fund companies, or the size of their advertising / marketing budgets, or their name recognition, or the opinion of external or internal experts . . . and it’s certainly not about incentives that fund companies may be offering to have their funds preferentially recommended. NO!

With the ProRRT℠, it’s now (just like in MONEYBALL) purely about performance!

Which of the mutual funds and ETFs, within any asset class, have proven best over time at producing the investment results you’re seeking for any one or more of your clients?

Reference to the movie provides clients with an easy-to-understand description of the process you are using . . . a unique process that clients can both actually watch you perform and in which they can participate.

But that’s only a part of why the ProRRT℠ is better than the system described in the movie.

In the movie, the comparative evaluation had to be done by a hired “Quant”, who created algorithms with which the comparisons were performed. No one but him really understood how to use it and (at least initially) almost no one trusted him or the results and recommendations he was producing.

But, as the movie documents, that ultimately changed.

Why?

It was because of the results – better players, better performance, and lower overall costs.

The proof?

They were winning. They were beating the competition!

How is the ProRRT℠ “better?”

What took who knows how much time for the team’s expert “Quant” to comparatively evaluate baseball players, can now be done for hundreds of mutual funds and ETFs in any asset class in mere moments.

And, most importantly, you don’t need to be a “Quant” to do it. You can easily and rapidly perform the scoring and ranking of the funds yourself.

Just as with the MONEYBALL process, the ProRRT℠ helps you identify and select mutual funds and ETFs that better match the composite investment performance (the desired combination of risk, return, and other factors) you’re seeking and often with lower overall costs.

The proof?

After more than a decade of testing, we saw that the mutual funds and ETFs picked with the aid of the ProRRT℠ were winning. We saw that they were beating the competition!

You can now see and, better yet, experience and prove this for yourself.

The MONEYBALL system has forever changed professional sports.

The Boston Red Sox now have as many as 35 people working on analyzing “sports metrics” for the evaluation and selection of players.

The ProRRT℠, in contrast, enables you alone to quickly and easily comparatively evaluate over 20,000 mutual funds and ETFs (many more choices than there are baseball players) for your clients’ investment “team” (the mutual funds and ETFs comprising their portfolios).

If your RIA or Bank has an internal group comparatively evaluating mutual funds and ETFs for its investment advisors to recommend, the ProRRT℠ will help make them much more time-efficient and much better at their jobs.

Our Goal is to similarly improve the way mutual funds and ETFs are evaluated and selected, by empowering you (and members of your investment advisor team) to do something even more extraordinary than what the movie describes – something never before available.

It’s the best of MONEYBALL and it’s now available to you and your RIA or Bank!